Business Overview

NTT Urban Development Asset Management Corporation, established in January 2015 with 100% of investment from NTT UD, is engaged in real estate fund management of listed NTT UD REIT Investment Corporation1, private NTT UD Private REIT Inc. and private real estate funds. Each business aims for stable growth in partnership with NTT Group including NTT UD.

- As of April 1, 2021, we merged with Premier REIT Advisors Co., Ltd. (PRA), the asset management company under the umbrella of the NTT UD Group managing the assets of Premier Investment Corporation (PIC)2, a listed REIT, and took over its business.

- As of April 1, 2021, PIC was renamed NTT UD REIT Investment Corporation.

Company Profile

| Name | NTT Urban Development Asset Management Corporation |

|---|---|

| Head Office |

Otemachi First Square East Tower 1-5-1 Otemachi, Chiyoda-ku, Tokyo

|

| Established | January 16, 2015 |

| Representative | Yutaka Torigoe, President and CEO |

| Paid-in Capital | 100 million yen |

| Shareholder Composition | NTT Urban Development Corporation (100%) |

| Principal Business Objectives |

|

|---|---|

| Licenses and Permits | |

| Associations |

History

- As of April 1, 2021, we merged with Premier REIT Advisors Co., Ltd. (PRA), the asset management company under the umbrella of the NTT UD Group managing the assets of Premier Investment Corporation (PIC), a listed REIT, and took over its business. As of the same day, PIC was renamed NTT UD REIT Investment Corporation.

Board of Directors

as of April 1, 2024

-

President & CEO

Yutaka Torigoe

-

April 1988Joined Nippon Telegraph and Telephone Corporation

-

November 2005Senior Manager in Charge, Finance Department, NTT Communications Corporation

-

July 2007Senior Manager in Charge, Human Resources Department, NTT Communications Corporation (Seconded to NTT Business Associe Corporation)

-

July 2010Senior Manager in Charge, Global Strategy Department, Global Business Division, NTT Communications Corporation

-

December 2011Senior Manager in Charge, Human Resources Department, NTT Communications Corporation (Seconded to Dimension Data Holdings plc)

-

July 2014Senior Manager in Charge, Global Business Office, Nippon Telegraph and Telephone Corporation (Seconded to Dimension Data Holdings plc)

-

June 2016General Manager, Accounting & Finance Department, NTT Urban Development Corporation

-

June 2018Senior Vice President, Accounting & Finance Department, NTT Urban Development Corporation

-

June 2021Senior Executive Vice President, NTT Urban Development Asset Management Corporation

-

June 2022President & CEO, NTT Urban Development Asset Management Corporation

-

-

Director, General Manager of Corporate Administration Department, overseeing Operation III Department and Internal Audit Office

Hiroshi Ogasawara

-

Director, General Manager of Operation I Department

Kazuhiro Kimura

-

Director, General Manager of Investment Marketing Department

Hajime Fukasawa

-

Director, General Manager of Operation II Department

Yasunori Onodera

-

Director & CFO, General Manager of Finance Department, overseeing Investor Relations Office

Takeshi Iwata

-

Director, Head of Engineering and Sustainability Management Office

Takeshi Oodera

-

Director (part-time)

Tatsuya Mazaki

-

Auditor (part-time)

Hiroyuki Fujimori

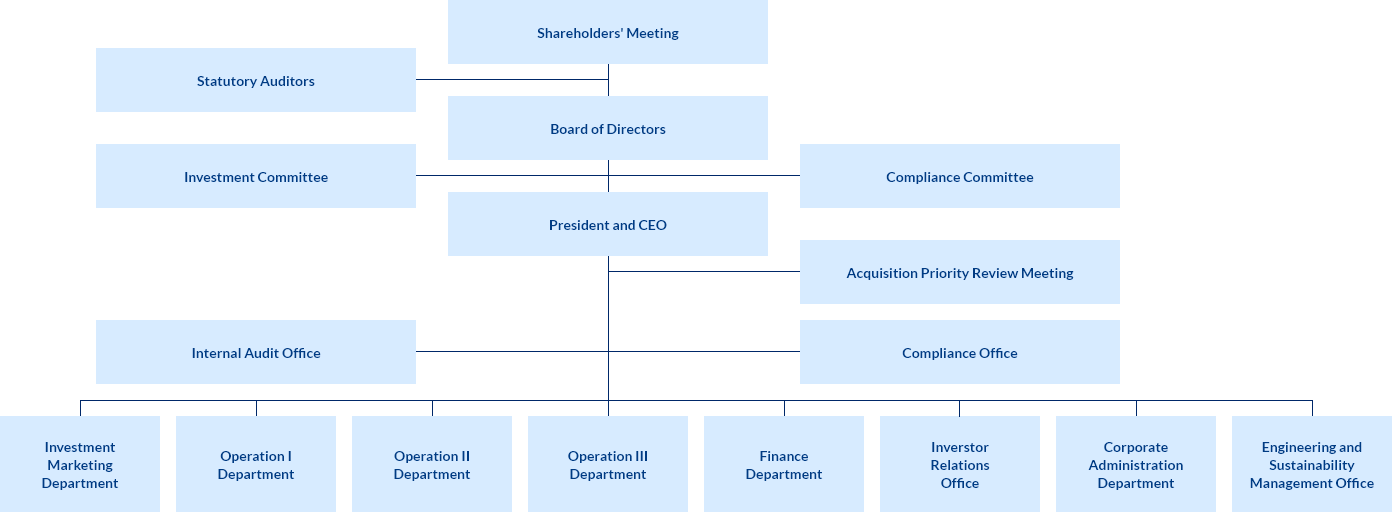

Organization

as of October 1, 2023

| Investment Marketing Department |

|

|---|---|

| Operation I Department |

|

| Operation II Department |

|

| Operation III Department |

|

| Finance Department |

|

| Investor Relations Office |

|

| Corporate Administration Department |

|

| Engineering and Sustainability Management Office |

|

Sustainability

The NTT Urban Solutions Group, to which NTT Urban Development Asset Management Corporation belongs, aiming at business that contribute to the realization of the sustainable society, on the basis of the Sustainability vision established by NTT Urban Solutions. Meanwhile, the investment management business industry has a growing recognition of the importance of Environment, Society and Governance (ESG) awareness. From the perspective of placing investors' interests as our top priority over the medium to long term, we work to reflect ESG awareness in all aspects of our real estate investment and management operations, centering on the following subjects.

-

Global warming countermeasures

We will promote energy saving and reduction of greenhouse effect gas emissions in managing the investment assets of the investment corporation that has consigned its asset management operations to us (the “investment assets”), by such measures as implementing energy management and introducing facilities for more efficient energy saving.

-

Measures to preserve water resources and reduce waste

We will continuously work on water saving measures to carefully and effectively use limited water resources, as well as on reduction of waste and promotion of recycling through meticulously separating recyclable and non-recyclable materials.

-

Ensuring safety and security

We will promote BCPs (business continuity plans) for office buildings and implement disaster prevention measures at residential properties, in both the physical and operational aspects of the buildings, based on the philosophy of NTT Urban Development Corporation’s Safety and Quality Policy.

-

Internal implementation and initiatives for officers and employees

We will establish an internal system to implement the initiatives based on this Policy, and educate and train our officers and employees on ESG awareness.

-

Coordination with outside stakeholders

We will coordinate with our tenants, service providers including property management companies and other stakeholders in an effort to enhance CS (customer satisfaction), as well as to achieve harmony with and vitalization of the local communities.

-

Information disclosure to investors, etc.

We will endeavor to proactively disclose information on our ESG awareness to investors and other stakeholders. Moreover, we will work to continuously obtain environmental certifications and assessments, including green building certifications, and disclose their details.

-

Compliance

We will conduct corporate activities in accordance with environmental preservation-related laws and regulations, fully aware of the importance of corporate ethics and compliance.

Based on the Sustainability Policy, NTT Urban Development Asset Management Corporation and NTT Urban Development REIT Investment Corporation recognize the importance of ESG considerations, have identified materiality (key issues) and strive to address these issues with the aim of supporting the realization of a sustainable society as a corporate responsibility.

→ Materiality (NTT UD REIT Investment Corporation website)